Emilia-Romagna Region promotes simplification, transparency and legality to ensure effective and reliable governance, together with easy and fast procedures for businesses and citizens.

Steps to set up a company

The Guide Doing Business in Italy elaborated by ITA – Italian Trade Agency contains useful information, including:

starting a business in Italy, hiring management and staff, IP regulation, taxation in Italy, financial and tax incentives in Italy.

Main steps

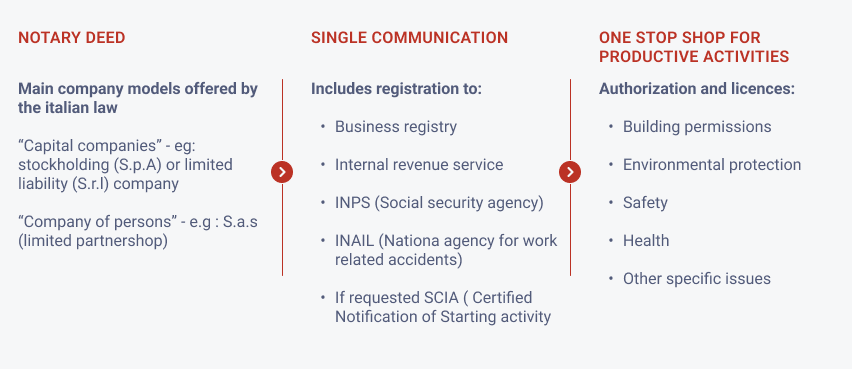

Foreign investors in Italy can choose from various different legal structures:

| COMPANY UNDER ITALIAN LAW | THE REPRESENTATIVE OFFICE | BRANCH OR SECONDARY OFFICE OF THE FOREIGN COMPANY |

|---|---|---|

| Main company models offered by the Italian law:

| Allows investors to promote themselves directly in the Italian territory at low set-up and management costs, without being subject to income tax. It can be used only the following purposes: storage, display or delivery of goods or services belonging to the foreign company; purchase of goods or services, information gathering, scientific or market research for the foreign company; performance of activities that are preparatory and auxiliary to those of the foreign company. | It is subject to normal Italian business taxation, obliged to keep account books, VAT records and file the annual financial statements of the foreign company. The branch office of a foreign company is subject to the same obligations as an Italian company as far as the publication of financial statements and other company documents are concerned. |

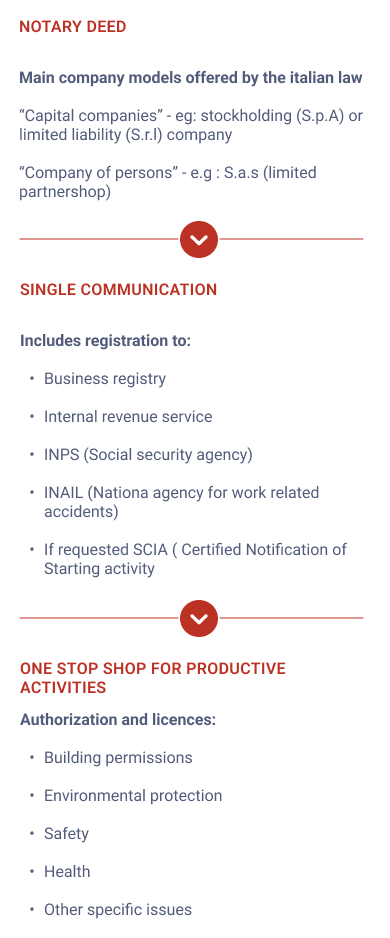

At national level, all the procedures required to register a company are processed electronically in a ‘Single Communication procedure’ that allows applicants to start their business activities on the same day. The procedure is valid for tax, social security and insurance purposes. After digital signature, it has to be submitted to the Business Registry Office of the territorial Chamber of Commerce.

The regional network of “One Stop Shop for Productive Activities” (SUAP: Sportello Unico per le Attività Produttive) assists businesses by providing a single online procedure to obtain authorisations and licences required to start a business, concerning health, safety, environmental protection, pollution and urban planning. The SUAP desks are widespread on the whole territory, aim to simplify bureaucracy and provide certain timeframes to complete the procedures.

Get support

-

Emilia-Romagna aims to support innovative investments with creation of qualified employment.

-

Regional and national incentives are available to support investments both in terms of grants and of facilitation in the relationships with the local territories and their stakeholders.

-

the Regional Law for the Promotion of Investments (L.R. 14/2014) supports innovative investments, the creation of R&D facilities, activities related to training and sustainability and much more.

Emilia-Romagna is a great location for new investments and offer properties with different features and characteristics. Our Contact Point provides support to find the right property. You will find a first selection on

● Invest in Emilia-Romagna Real Estate: https://realestate.investinemiliaromagna.eu/en/

● Invest in Italy: Regional properties available on Invest in Italy real Estate